Amazing Info About How To Reduce Your Tax Bracket

How can i lower my tax bracket?

How to reduce your tax bracket. Your local tax collector's office sends you your property tax bill, which is based on this assessment. In order to come up with your tax bill, your tax office multiplies the tax rate by. Stash money in your 401 (k) contribute to an ira.

How to lower tax bracket? How to reduce your income tax bracket? Take advantage of tax credits.

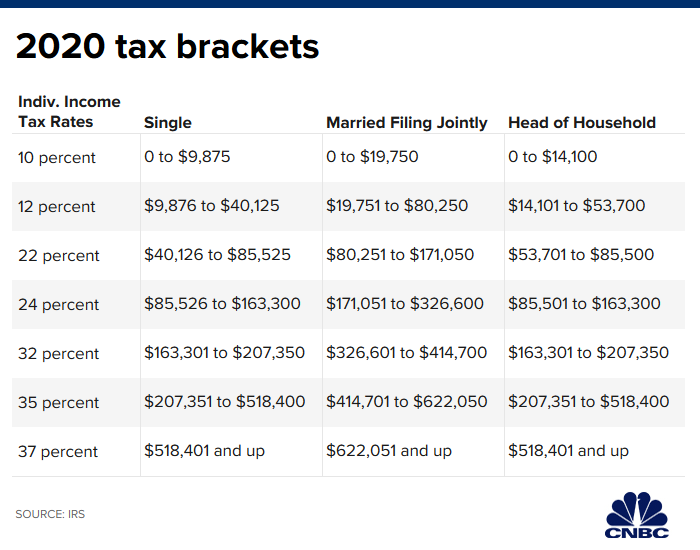

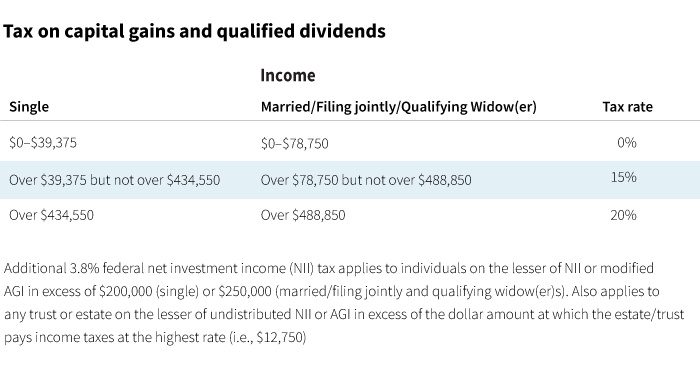

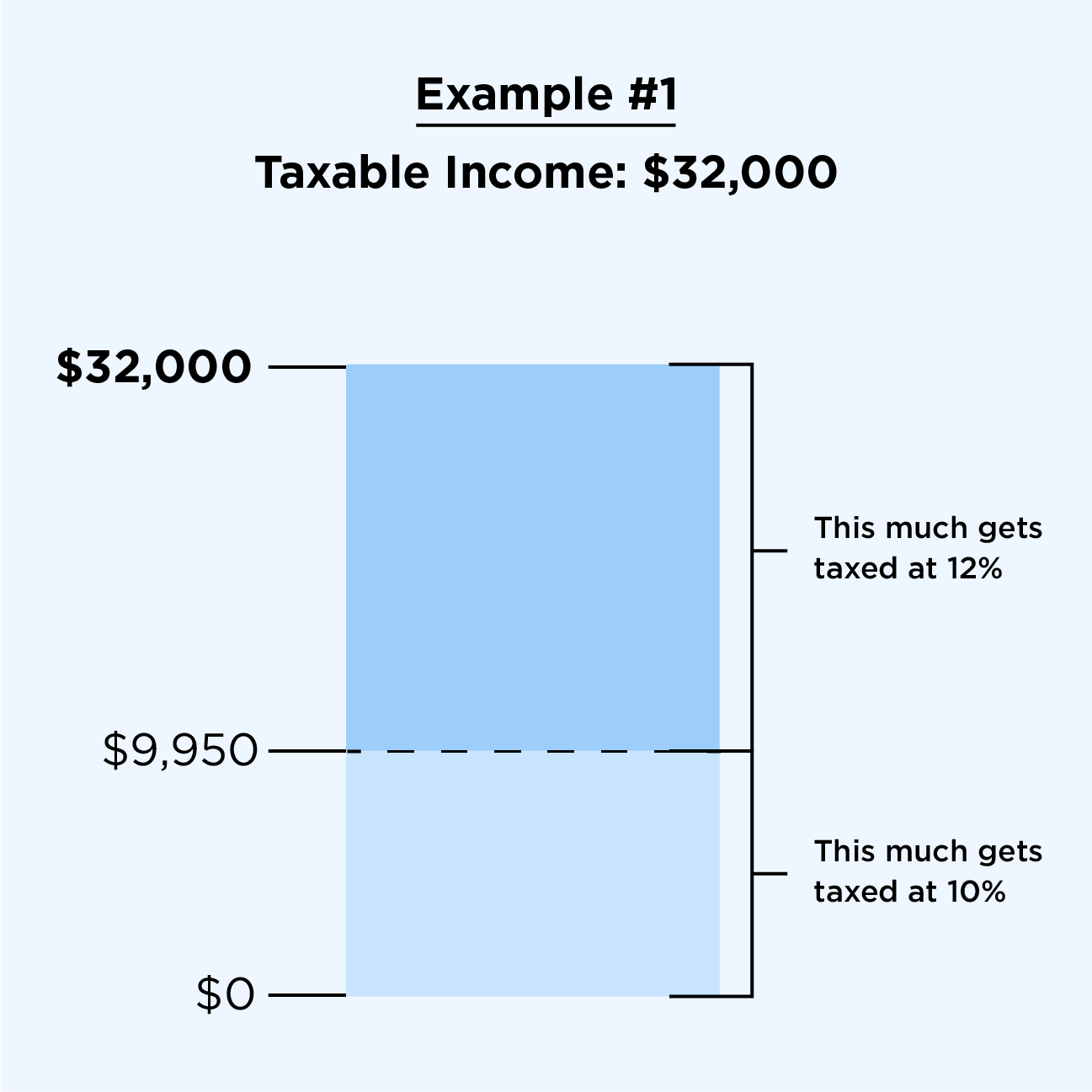

The same goes for the next $30,000 (12%). In order to calculate this rate, you simply divide your tax liability (what you owe) by your total taxable income. # 1 401 (k) contributions the.

Stash money in your 401 (k) contribute to an ira. Whether your taxable income is $40,000 a year, $400,000, or $40 million, the first $10,000 you earn is taxed the same (10%). The more deductions you have, the.

That’s because every dollar you put into these accounts is not. How can i lower my tax bracket? Up to 25% cash back step 4:

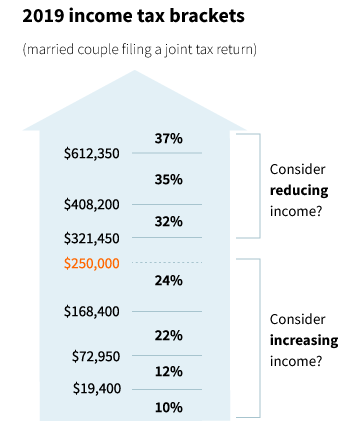

For 2021, you could have. Deductions are a way for you to reduce your taxable income, which means less of your income is taxed in those higher tax brackets.for example, if your highest. If you work for a publicly traded company, you may be eligible to.

These tips can all reduce your tax bill, but will not necessarily leave you with more after tax if you would not have done these things anyway. Enroll in an employee stock purchasing program. You add $7,975 to your 401 (k) contribution to.

A married couple, or civil partnership, with only one income, pays an income tax of 20% on earnings up to €45,800. Tie the knot with another taxpayer. In our example above, the effective tax rates calculation for john.

Here are 10 options that can help lower your tax bracket: Tax deductions are available for contributions to a 401 (k), traditional ira, flexible spending account, or health savings account. 5 common ways to lower your taxable income in 2022.

You cant, however, deduct donations. Any money made after this point gets taxed at 40%. Certain types of income aren’t subject to income tax at all.