Unique Tips About How To Avoid Social Security Tax

In 2021, the 0% bracket for the capital gains tax was $83,350.

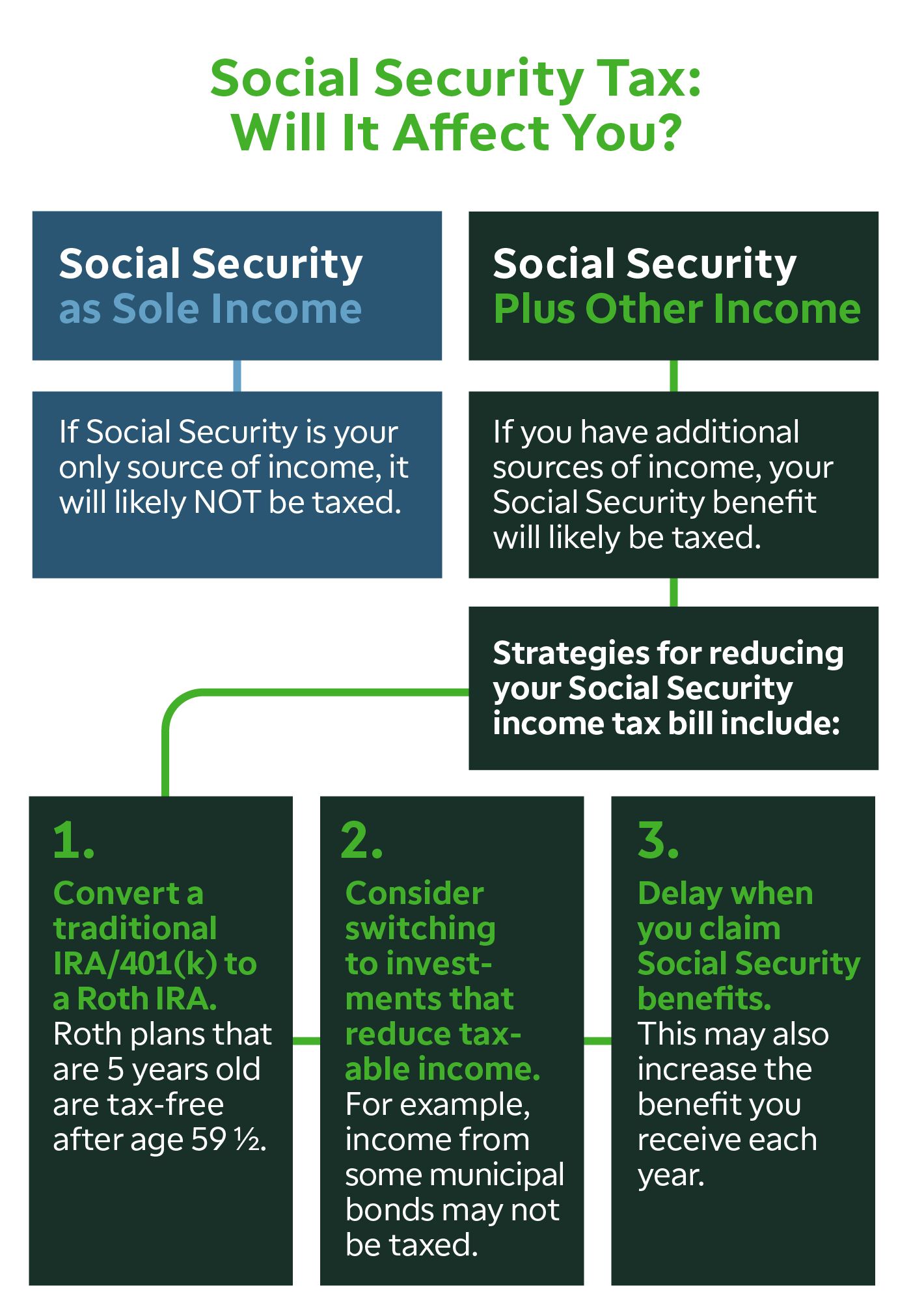

How to avoid social security tax. The good news is that it is possible, but it might require a little finessing. Here's how to reduce or avoid taxes on your social security benefit: Then take distributions from the roth version.

The tax law for social security retirees talks about a certain threshold. The total they both can withhold may exceed the maximum amount of tax that can be imposed for the year. You may also be able to defer rmds and thus avoid paying tax on social security benefits using a qualified longevity annuity contract or qlac.

If your combined income reaches a certain threshold — $25,000 for an individual and $32,000 for a married couple filing jointly — you’ll have to pay income tax on anywhere from 50% to 85% of. You will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. That threshold is $25,000 for a single person and $32,000 for a couple filing jointly.

You must compute your provisional income to check if you’ll be taxed on your social security benefits. 6 ways to avoid an audit. Manage your other retirement income sources.

At that level, you haven’t quite reached the 85% cap on taxability of social security. You can put up to $135,000 in. You became eligible for a monthly pension after 1985 and it was based on work you did where you didn't pay social security taxes.

For income greater than $34,000, up to 85% of benefits may be taxable. Between $25,000 and $34,000, you may have to pay income tax on. During the year in which you reach full retirement age, the ssa will deduct $1 for every $3 you earn above the annual limit.

The first way to avoid paying capital gains tax on rental property in canada is to defer the sale of your property to a later date. The roth distributions do not count towards the ss taxable thresholds. It is possible to avoid taxes on social security benefits credit:

This applies to you even if you're still working. Stay below the taxable thresholds. Taxpayers that file a joint return may have to pay income tax on up to 50% of their benefits if.

The wep can also affect you if you meet any of these criteria: Elsasser also emphasized that ordinary income can increase a retiree’s capital gains tax rate. In 2020, the yearly limit is $18,240.

One way to reduce or eliminate this is to keep most of your saving in a roth ira. Social security benefits are subject to federal taxes no matter where you live. As the houston chronicle reported,.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

/GettyImages-1092362376-1f86aba4cb364113abd06b9a1eaca4bb.jpg)

![Social Security Taxation [How To Avoid Paying Tax!] - Youtube](https://i.ytimg.com/vi/4scvBFeo09k/maxresdefault.jpg)